Markets

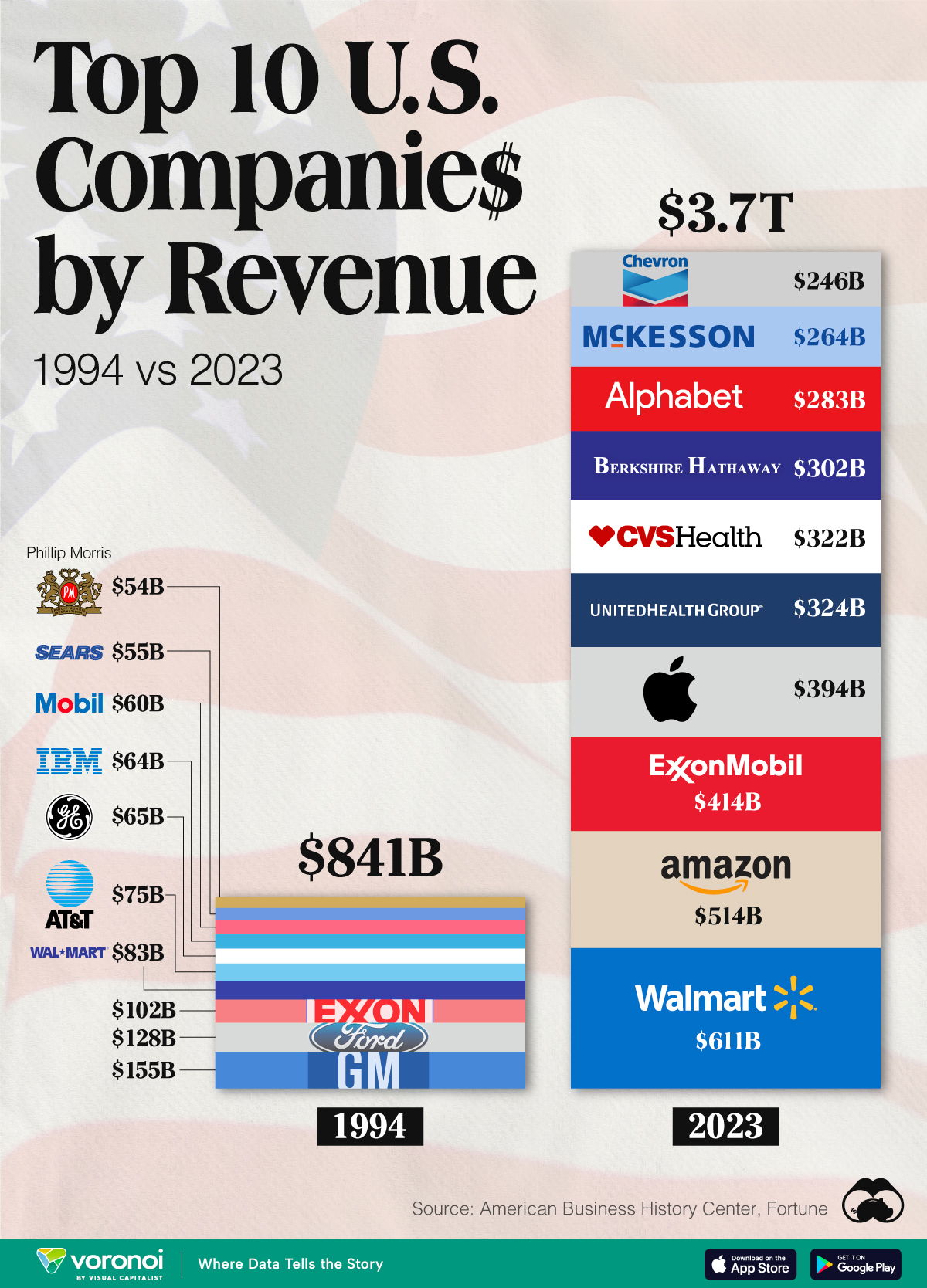

America’s Top Companies by Revenue (1994 vs. 2023)

![]() See this visualization first on the Voronoi app.

See this visualization first on the Voronoi app.

America’s Top Companies by Revenue (1994 vs. 2023)

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

A lot has changed since the 1990s, especially in the business world.

To highlight these changes, we’ve visualized the top 10 U.S. companies by revenue, in both 1994 and 2023. Figures for 1994 were sourced from the American Business History Center, while 2023 figures come from the latest Fortune 500 ranking.

Note that 1994 figures were not adjusted for inflation, but we’ll get to that further below.

| Company (1994) | Revenue ($B) | Company (2023) | Revenue ($B) |

|---|---|---|---|

| General Motors | 155 | Walmart | 611 |

| Ford | 128 | Amazon | 514 |

| Exxon | 102 | Exxon Mobil | 414 |

| Walmart | 83 | Apple | 394 |

| AT&T | 75 | UnitedHealth Group | 324 |

| General Electric | 65 | CVS Health | 322 |

| IBM | 64 | Berkshire Hathaway | 302 |

| Mobil | 60 | Alphabet | 283 |

| Sears | 55 | McKesson | 264 |

| Philip Morris | 54 | Chevron | 246 |

| Total | 841 | Total | 3,674 |

Based on this data, we can see that today’s top 10 list looks very different from what it used to.

Remembering the Nineties

Before Big Tech, the Big Three automakers dominated the American business landscape (Chrysler ranked 11th in 1994, just behind Philip Morris).

Speaking of Philip Morris, the company is now known as Altria following a major 2003 rebranding. The change was made due to the company’s diversification outside of tobacco.

Another big change that has occurred since 1994 is the merger of Exxon and Mobil, currently known as ExxonMobil. It’s interesting to note that ExxonMobil is just one of two companies still in the top 10 today (the other being Walmart).

Inflation-Adjusted Figures

Based on U.S. CPI data, the inflation rate from 1994 to 2023 is approximately 105.6%.

See below for the inflation adjusted revenue figures of 1994’s top 10 companies.

| Company (1994) | Revenue ($B) (Inflation adjusted) | Company (2023) | Revenue ($B) |

|---|---|---|---|

| General Motors | 319 | Walmart | 611 |

| Ford | 263 | Amazon | 514 |

| Exxon | 210 | Exxon Mobil | 414 |

| Walmart | 171 | Apple | 394 |

| AT&T | 154 | UnitedHealth Group | 324 |

| General Electric | 134 | CVS Health | 322 |

| IBM | 132 | Berkshire Hathaway | 302 |

| Mobil | 123 | Alphabet | 283 |

| Sears | 113 | McKesson | 264 |

| Philip Morris | 111 | Chevron | 246 |

| Total | 1,618 | Total | 3,674 |

Even after accounting for inflation, the biggest companies of 1994 are still far behind when it comes to revenue.

One interesting takeaway is Walmart’s growth over this roughly three-decade period. Not only is Walmart currently the world’s biggest company by revenue, it’s also America’s biggest employer.

Maps

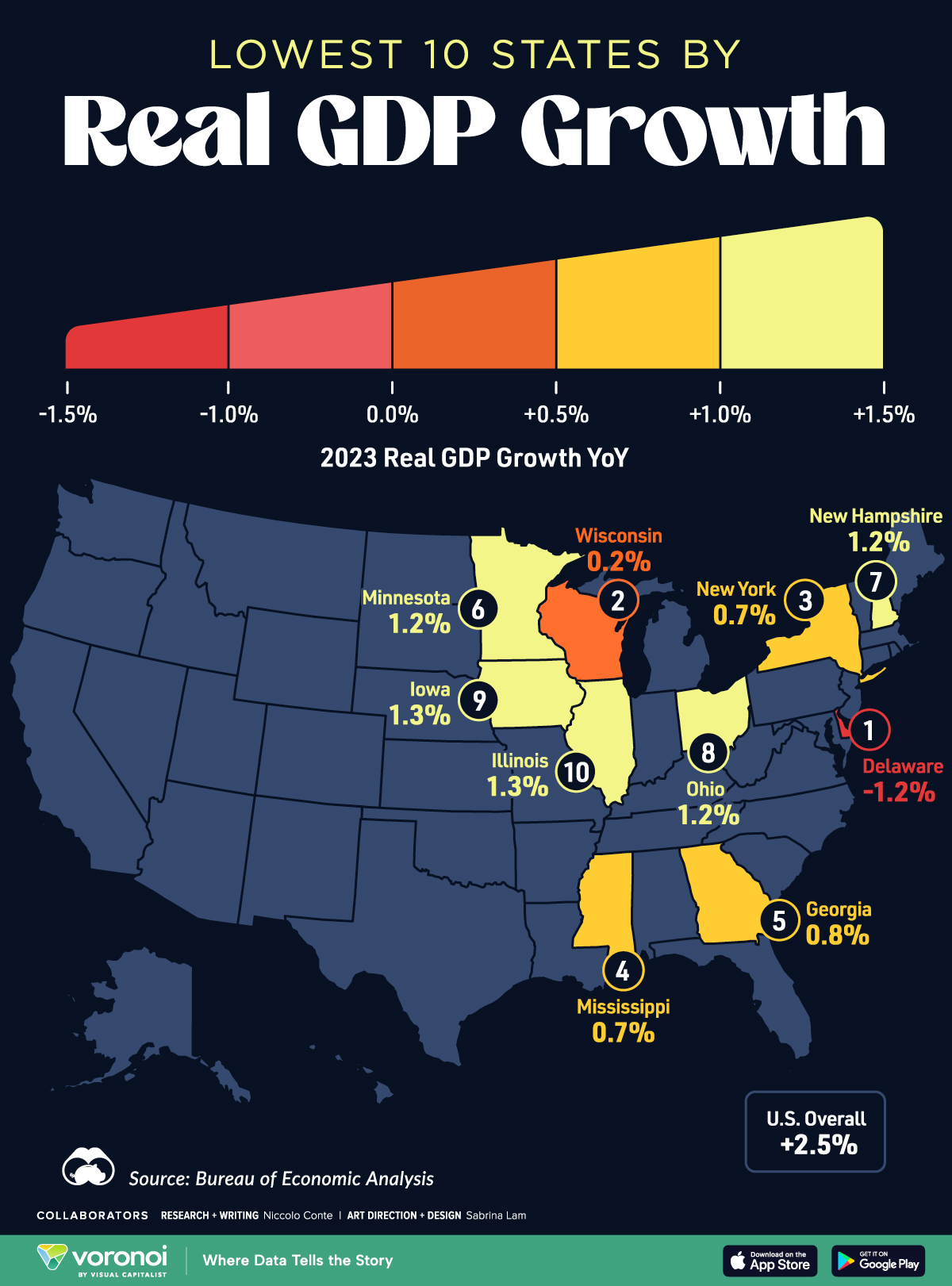

Mapped: The 10 U.S. States With the Lowest Real GDP Growth

In this graphic, we show where real GDP lagged the most across America in 2023 as high interest rates weighed on state economies.

The Top 10 U.S. States, by Lowest Real GDP Growth

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

While the U.S. economy defied expectations in 2023, posting 2.5% in real GDP growth, several states lagged behind.

Last year, oil-producing states led the pack in terms of real GDP growth across America, while the lowest growth was seen in states that were more sensitive to the impact of high interest rates, particularly due to slowdowns in the manufacturing and finance sectors.

This graphic shows the 10 states with the least robust real GDP growth in 2023, based on data from the Bureau of Economic Analysis.

Weakest State Economies in 2023

Below, we show the states with the slowest economic activity in inflation-adjusted terms, using chained 2017 dollars:

| Rank | State | Real GDP Growth 2023 YoY | Real GDP 2023 |

|---|---|---|---|

| 1 | Delaware | -1.2% | $74B |

| 2 | Wisconsin | +0.2% | $337B |

| 3 | New York | +0.7% | $1.8T |

| 4 | Missississippi | +0.7% | $115B |

| 5 | Georgia | +0.8% | $661B |

| 6 | Minnesota | +1.2% | $384B |

| 7 | New Hampshire | +1.2% | $91B |

| 8 | Ohio | +1.2% | $698B |

| 9 | Iowa | +1.3% | $200B |

| 10 | Illinois | +1.3% | $876B |

| U.S. | +2.5% | $22.4T |

Delaware witnessed the slowest growth in the country, with real GDP growth of -1.2% over the year as a sluggish finance and insurance sector dampened the state’s economy.

Like Delaware, the Midwestern state of Wisconsin also experienced declines across the finance and insurance sector, in addition to steep drops in the agriculture and manufacturing industries.

America’s third-biggest economy, New York, grew just 0.7% in 2023, falling far below the U.S. average. High interest rates took a toll on key sectors, with notable slowdowns in the construction and manufacturing sectors. In addition, falling home prices and a weaker job market contributed to slower economic growth.

Meanwhile, Georgia experienced the fifth-lowest real GDP growth rate. In March 2024, Rivian paused plans to build a $5 billion EV factory in Georgia, which was set to be one of the biggest economic development initiatives in the state in history.

These delays are likely to exacerbate setbacks for the state, however, both Kia and Hyundai have made significant investments in the EV industry, which could help boost Georgia’s manufacturing sector looking ahead.

-

Personal Finance1 week ago

Personal Finance1 week agoVisualizing the Tax Burden of Every U.S. State

-

Misc6 days ago

Misc6 days agoVisualized: Aircraft Carriers by Country

-

Culture6 days ago

Culture6 days agoHow Popular Snack Brand Logos Have Changed

-

Mining1 week ago

Mining1 week agoVisualizing Copper Production by Country in 2023

-

Misc1 week ago

Misc1 week agoCharted: How Americans Feel About Federal Government Agencies

-

Healthcare1 week ago

Healthcare1 week agoWhich Countries Have the Highest Infant Mortality Rates?

-

Demographics1 week ago

Demographics1 week agoMapped: U.S. Immigrants by Region

-

Maps1 week ago

Maps1 week agoMapped: Southeast Asia’s GDP Per Capita, by Country